Separately Managed Accounts for Non-U.S. Investors

With a separately managed account, OTG Asset Management LTD offers you a customized portfolio designed to help meet your specific financial objectives. The portfolio can hold stocks, bonds, mutual fund, ETFs and alternative investments, both from the region as well as across the globe, as suited to your risk tolerance, timeframe and goals.

A separately managed account offers a number of advantages.

- Tailored to you, managed according to your financial objectives, risk tolerance and timeframe.

- Personalized asset allocation and risk management.

- Sensitive to personal preferences such as socially responsible investing principles.

- Customized to address your tax situation, liquidity and tax flow needs.

- Transparency about all account activity and holdings.

- Managed with your best interests in mind.

- Portfolio managers highly experienced in investing in the region.

- Excellence in client service and reporting.

Who We Serve

Separately managed accounts are suitable for individuals and families with significant investable assets. Institutions, corporations and non-profits may also benefit from customized asset management. We will work with your family or board to prepare an investment policy statement that reflects your wishes and guides your investments.

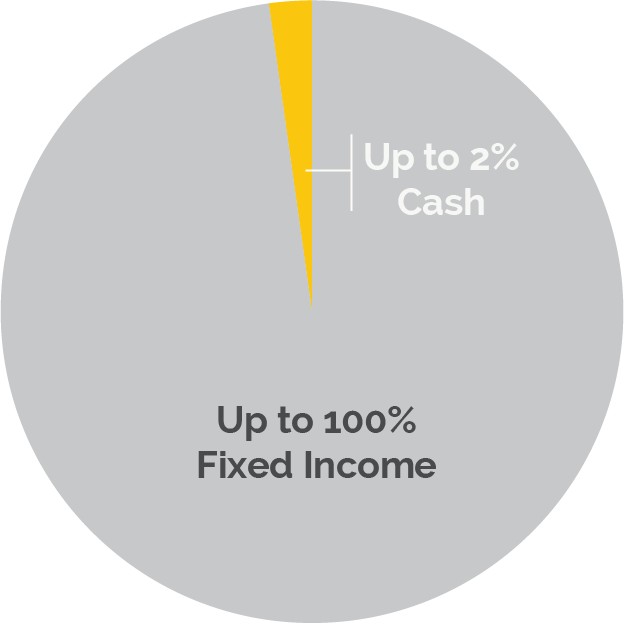

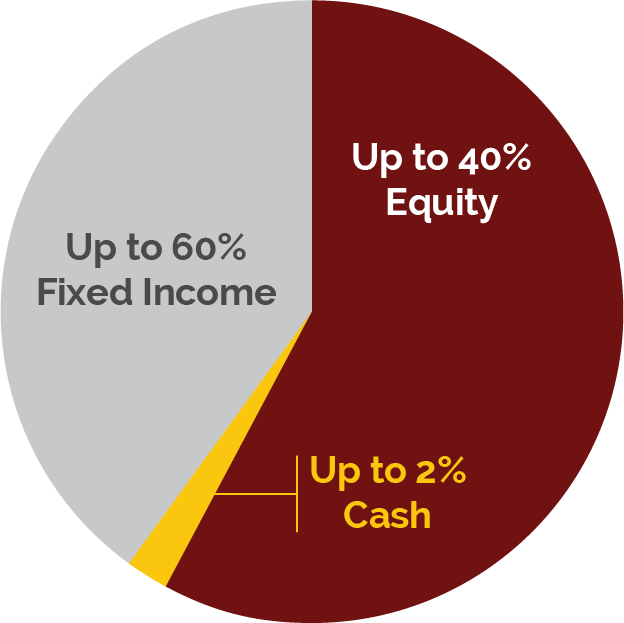

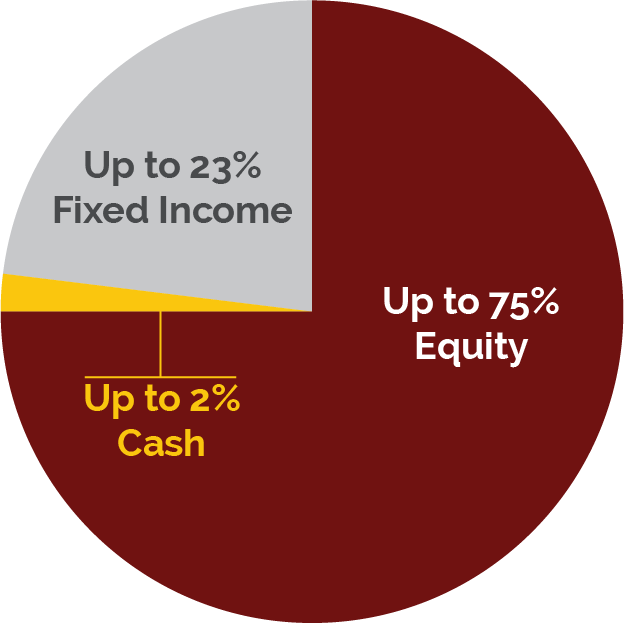

Hypothetical Portfolio Allocations

Conservative

Objective: Capital preservation and income.

Moderate

Objective: Balanced exposure between performance and risk, Seeks investment growth with capital preservation.

Dynamic

Objective: Capital growth and return.